Robinhood: The Disruptor Democratizing Finance | Disruptors Unplugged

Wall Street has long been synonymous with conservatism, but even the most rigid systems are vulnerable to disruption. Enter Robinhood—a fintech insurgent that has consistently rewritten the rules of the game. Since its founding in 2013, Robinhood has evolved from a mobile brokerage upstart into a full-stack financial platform, catalyzing structural shifts across global capital markets.

As of market close on July 18, Robinhood (NASDAQ: HOOD) had reached a market capitalization of $96.842 billion, approaching the $100 billion mark. Analysts across Wall Street have been raising their price targets, while media headlines increasingly refer to a “Robinhood resurgence” and describe the company as a “new force in finance.”

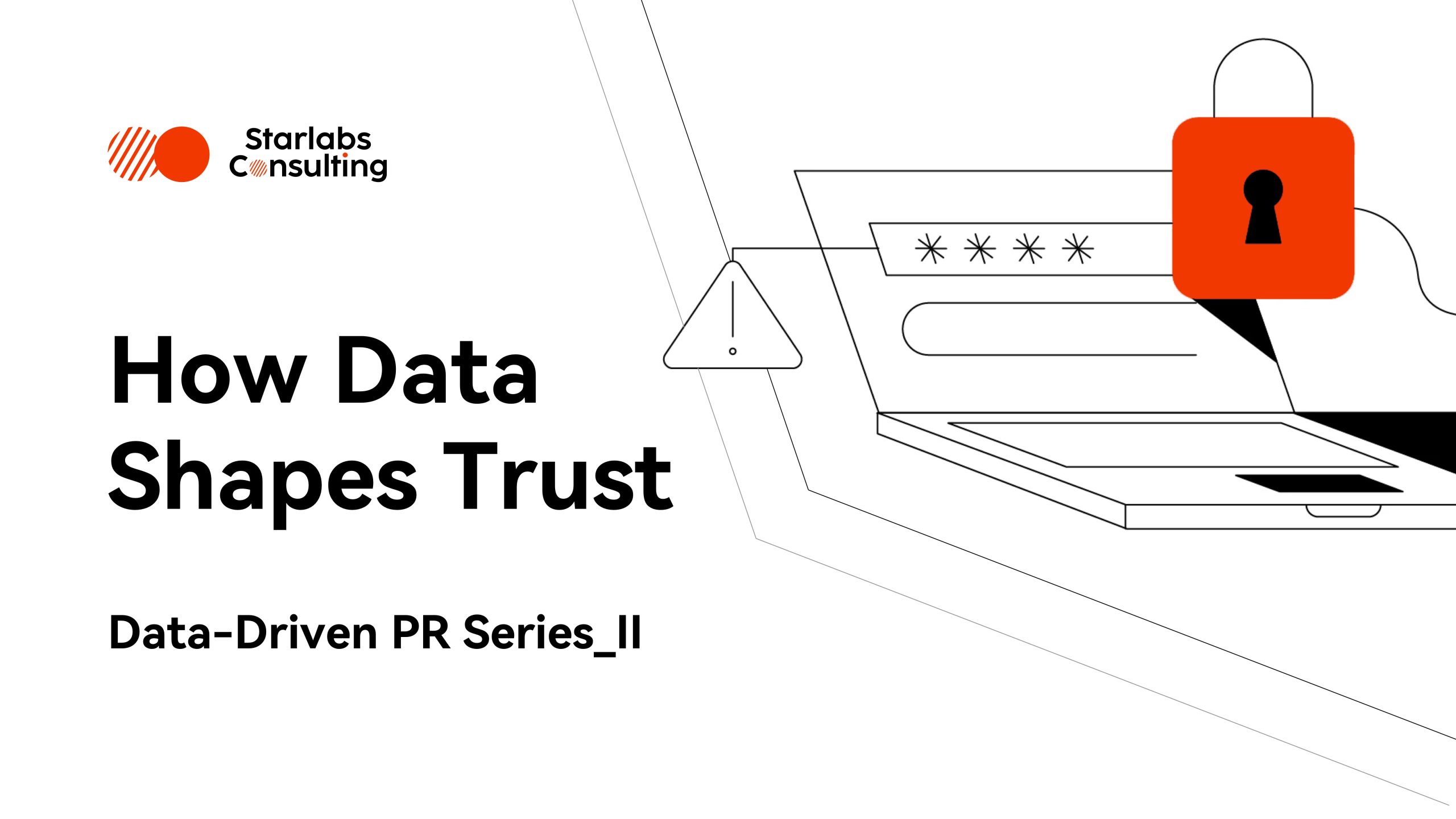

Just over two weeks earlier, on June 30, Robinhood dropped a major announcement: the launch of Robinhood Stock Tokens, allowing EU-based customers to trade U.S. stocks and ETFs on the blockchain. The news sent shockwaves through both traditional financial circles and the crypto world, pushing the company’s stock up 12.77% that day.

For those familiar with Robinhood’s history, the move was far from surprising. Since its inception in 2013, the company has made a name for itself through a series of disruptive innovations that have repeatedly challenged and rewritten the rules of traditional finance. From the “zero-commission revolution” of 2013 to the retail investor uprising of 2021, from offering crypto trading in 2018 to launching tokenized equities today, Robinhood has consistently kept pace with the times—often positioning itself as the protagonist of a new financial narrative.

Tokenized Stocks: Delivering “Capital-as-a-Service”

On June 30, 2025, Robinhood announced the launch of its tokenized U.S. stocks and ETFs service in the EU. Eligible users can now invest in over 200 tokenized U.S. stocks and ETFs—including popular names such as NVIDIA (NASDAQ: NVDA) and Tesla (NASDAQ: TSLA)—with 24/5 real-time trading support. The platform also offers tokenized equity in private companies such as SpaceX and OpenAI.

This move breaks down the geographic and time-based barriers to traditional securities investment, dramatically lowering the entry threshold—users can participate with as little as $1.

Additionally, Robinhood now allows European customers to trade crypto perpetual futures. With a single Robinhood account, users can access a one-stop platform for trading stocks, ETFs, options, bonds, money market funds, spot and derivative crypto assets, tokenized stocks, as well as cash management, savings, and IPO subscriptions.

“What people really want isn’t a complex financial toolkit, but ‘Capital-as-a-Service’—press a button, and capital flows into your account,” said Robinhood co-founder and CEO Vladimir Tenev during a recent appearance on the well-known podcast The Twenty Minute VC. He described this model as potentially revolutionary in three ways:

- Lowering the threshold for entrepreneurship: enabling businesses at any stage to access capital quickly.

- Market-based pricing: letting the market—not a handful of VCs—determine valuation.

- Liquidity unlock: converting illiquid assets into tradable digital tokens.

According to Tenev, tokenization brings two core values:

- Global Accessibility: making it easier for investors outside the U.S. to gain exposure to U.S. assets.

- Democratization of Illiquid Assets: allowing retail investors to access previously off-limits assets such as private equity and real estate.

Starlabs Consulting sees Robinhood’s move into tokenized stocks as a deep structural shift in global finance—one on par with its earlier zero-commission trading revolution.

Zero-Commission Revolution: Making Investing Accessible to Everyone

Back in 2015, Robinhood’s founders, Vladimir Tenev and Baiju Bhatt, launched the idea of zero-commission trading with the mission of “making investing accessible to all.” At the time, traditional brokers on Wall Street charged between $7 to $10 per trade, effectively locking out small investors. Robinhood flipped that model—users could buy and sell U.S. stocks commission-free, right from their smartphones.

Instead of charging commissions, Robinhood generated revenue through three core streams:

- Payment for Order Flow (PFOF): routing user orders to market makers who pay Robinhood for the order flow.

- Robinhood Gold: a premium subscription offering margin trading and research tools.

- Interest on uninvested cash: parked in user accounts.

Although the PFOF model has drawn scrutiny, it has provided a sustainable foundation for the zero-commission approach. The impact of this model rippled across the financial industry. On October 1, 2019, market leader Charles Schwab announced it would eliminate online trading commissions for U.S. stocks, ETFs, and options. Others followed suit—TD Ameritrade, E*Trade, Fidelity. That day came to be known as “Zero Commission Monday.”

The zero-commission revolution is estimated to save U.S. retail investors billions of dollars annually. It also transformed investor behavior—without commissions, users were more willing to trade smaller amounts and rebalance portfolios frequently. Robinhood reported in 2021 that the average user age was just 31, far younger than that of traditional brokerages.

While the broader brokerage industry saw profit margins drop over 20% due to the fee cuts, user numbers surged and investing became more inclusive. Today, zero-commission trading is the new norm—and Robinhood’s disruptive innovation is now embedded in Wall Street’s operating model.

But as Tenev once said, “Zero commission was just the first step in our mission to expand access to financial markets.”

Winning Young Investors: Mobile-First + Gamification Design

Robinhood’s mobile-first strategy capitalized on Millennials and Gen Z’s preference for mobile investing. Its app was sleek, intuitive, and designed to make investing feel more like a game than a chore—contrasting sharply with the complex desktop interfaces of legacy brokers.

To attract young users, Robinhood introduced gamified UI elements: colorful animations during price movements, celebratory screen flashes after successful trades, and a fun, engaging experience overall.

Critics warned that this design could encourage overtrading and downplay the seriousness of investing. But there’s no denying it boosted participation—so much so that it helped spark the infamous “retail vs. Wall Street” showdown.

In early 2021, Reddit’s WallStreetBets community led a massive short squeeze campaign against hedge funds, targeting heavily shorted stocks like GameStop (NYSE: GME). Robinhood, as the go-to platform for retail investors, became ground zero for the financial uprising. Millions of users bought into GME, sending its price soaring by multiple magnitudes. Hedge funds incurred huge losses, and Wall Street was stunned.

Robinhood’s decision to temporarily restrict trading of volatile stocks during the frenzy provoked user outrage and congressional hearings. Despite the backlash, the GameStop saga became a symbol of retail investor empowerment—and cemented Robinhood as a central player in the fintech revolution.

The Economist remarked that technology had, for the first time, allowed millions of ordinary people to go head-to-head with Wall Street giants.

Bridging Web2 and Web3: A Pioneer in Crypto Integration

Robinhood was among the first traditional finance platforms to offer crypto trading. In 2018—when Warren Buffett was still calling Bitcoin “rat poison squared”—Robinhood launched BTC and ETH trading.

This bold move broadened the company’s scope and blurred the lines between crypto and traditional finance, accelerating the mainstream adoption of digital assets. Robinhood has since expanded its crypto footprint:

- 2021: Acquired crypto aggregator Cove Markets.

- 2022: Launched Robinhood Wallet, supporting Ethereum, Polygon, Arbitrum, Optimism, and Base networks.

- May 2025: Acquired WonderFi (owner of regulated platforms Bitbuy and Coinsquare in Canada).

- May 2025: Received a brokerage license from Lithuania’s central bank, enabling pan-EU stock and crypto investment services under MiCA.

- June 2024: Acquired legacy exchange Bitstamp, gaining access to over 50 licenses globally and a MiFID multilateral trading facility for crypto derivatives.

- June 30, 2025: Announced tokenized stocks and ETFs, along with plans for a proprietary Layer 2 blockchain, Robinhood Chain.

- July 1, 2025: Acquired AI-powered investment advice platform Pluto.

Robinhood now offers full-stack coverage across spot and derivative crypto trading, staking, wallets, RWA tokenization, and AI-based strategy analytics—positioning itself as a next-gen financial super app. The company has also advocated for tokenization legislation in the U.S., proposing a national RWA framework to the SEC and preparing to launch a platform called Real World Asset Exchange for off-chain trading and on-chain settlement.

Tenev revealed that Robinhood now has nine product lines generating hundreds of millions of dollars annually, categorized as:

- Core: Stock trading, options, crypto

- Sticky: Robinhood Gold, cash management

- Innovative Growth: Instant withdrawal, tokenization

- Premium Expansion: Private banking, prediction markets

Robinhood’s financial reports have repeatedly highlighted surging crypto volumes and revenues. Analysts estimate that in Q1 2025, crypto trading revenue accounted for roughly 30% of Robinhood’s transactional income—around $175 million—up 5–10 percentage points from Q1 2024.

From traditional securities to cutting-edge blockchain finance, Robinhood has evolved into a holistic financial infrastructure platform spanning Web2 and Web3.

The Disruptor DNA: Making Finance More Fair and Inclusive

At every stage of its expansion, Robinhood has challenged the traditional order of the financial services industry. Each act of disruptive innovation has been rooted in a single mission: to make finance more fair and more inclusive.

Fractional Shares: A Breakthrough in Asset Accessibility

Robinhood was among the first brokerages in the United States to introduce fractional share trading, a feature that aligns closely with the ethos of cryptocurrencies, which are infinitely divisible (for example, Bitcoin’s smallest unit is 0.00000001 BTC, or one satoshi).

Fractional shares enable users with just a few dollars to invest in high-priced stocks of major companies and participate in the value creation of top-tier global assets. This represents a meaningful step toward the democratization of investing.

According to Robinhood’s official data, the number of users engaged in fractional share trading surpassed 20 million in 2023, accounting for over half of the platform’s total user base.

Cash Management: Bridging Everyday Spending and Investing

In 2022, Robinhood launched the Robinhood Cash Card, a debit card offering up to 3% cashback. This service seamlessly integrates users’ investment accounts with their daily spending, allowing for direct fund transfers between transactions, cash withdrawals, and investment portfolios. The result is a more connected and integrated personal financial ecosystem.

Robinhood also rolled out instant deposit and withdrawal capabilities, enabling eligible users to withdraw a portion of their funds immediately after selling stock—without having to wait for the traditional 2–3 day clearing period.

Retirement Accounts: Attracting Long-Term Investors

Also in 2022, Robinhood introduced Robinhood Retirement, a service offering Individual Retirement Accounts (IRAs) with a 1% match incentive. For every dollar a user deposits into their IRA, Robinhood contributes an additional 1%—a benefit typically reserved for employer-sponsored 401(k) plans, but now made available to all retail investors directly by Robinhood.

This strategic move—unexpected from a platform known for short-term trading—has helped diversify its user base and attract more long-term, wealth-building investors.

As of 2024, Robinhood boasts over 25 million registered users, more than 17 million active users, and over $139 billion in assets under custody, representing a 116% increase from 2023.

Behind these numbers lies a deeper signal: financial services are undergoing a historic shift toward unprecedented democratization. Robinhood’s innovations in fractional investing, cash management, and long-term savings are not just product features—they are structural catalysts reshaping how everyday people engage with financial markets.

Founders of Robinhood: Visionaries with a Mission

Whether it’s their boldness in challenging the status quo, their relentless drive for innovation, or the profound impact they’ve had on the industry—not to mention their immigrant backgrounds—Robinhood’s two co-founders bear more than a passing resemblance to the “tech maverick” Elon Musk.

Vladimir Tenev was born in Bulgaria in 1987 and immigrated to the U.S. with his parents as a child. Baiju Bhatt was born in India and raised in the U.S. Both shared a deep passion for financial markets.

Baiju Bhatt (lfet) and Vlad Tenev(right)

The two Stanford alumni had already co-founded two high-frequency trading software firms, Celeris and Chronos Research, before starting Robinhood. These experiences exposed them to the structural inequalities embedded within traditional financial systems and fueled their ambition to level the playing field—making markets fairer and more open.

In 2013, they founded Robinhood, a name inspired by the legendary English outlaw who “stole from the rich to give to the poor.” Their mission was simple but powerful: leverage technology and business model innovation to dismantle Wall Street’s monopoly and make financial markets accessible to everyone, not just the privileged few.

a still from Robin Hood: The Rise

In the early days, the pair pitched their idea to 75 venture capital firms—only to be rejected 74 times. But rather than giving up, each rejection only strengthened their resolve. In an interview, Bhatt once said, “Every ‘no’ reaffirmed that we were on the right path.”

Driven by this strong sense of mission, the two remained deeply involved as Robinhood scaled rapidly, never losing sight of the passion that ignited their journey.

During the 2021 GameStop short squeeze, Robinhood faced a major backlash after it restricted the purchase of certain stocks, sparking anger among users and drawing the attention of U.S. Congress. Amid mounting pressure, Tenev voluntarily appeared before a congressional hearing, candidly explaining the company’s risk management challenges. In the aftermath, Robinhood strengthened its system stability and risk controls, while placing more emphasis on investor education, helping users develop more sustainable investing habits.

In 2025, after launching equity tokens for OpenAI and SpaceX, Robinhood encountered pushback from both companies. Tenev responded, saying that while the resistance was understandable, it was ultimately unfair—reflecting the fundamental issue of adverse selection in the private investment market. Top-tier companies have ample funding options and thus rarely consider retail investors. Yet tokenization’s core innovation, he argued, lies in the fact that “it can function without the consent of the tokenized company.” This speaks to Robinhood’s core ethos: removing human-imposed barriers in financial services and making elite financial opportunities accessible to all.

From a leadership perspective, Tenev advocates flat hierarchies and rapid experimentation, encouraging teams to challenge authority and embrace change.

A self-professed enthusiast of cryptocurrencies and AI, he often personally contributes to product design and user experience. He’s stated that technologies like blockchain and artificial intelligence will continue to drive financial innovation—and Robinhood intends to stay at the forefront of this transformation.

As Tenev himself has said: “Zero commission was only the beginning.”

About Starlabs Consulting

Starlabs Consulting is a global leader in strategic and marketing consulting for the Web3 industry. Founded in 2018, we specialize in delivering end-to-end solutions across strategic planning, financial advisory, PR and marketing, risk forecasting and management, regulatory and legal compliance, crisis management, and innovation research.

We are committed to helping visionary companies navigate complexity in their growth, marketing, and operations — empowering them to thrive in competitive markets. With deep Web3 expertise and an extensive global network, Starlabs Consulting is the trusted partner of choice for many of the world’s leading crypto exchanges. Our professional team is known for its strategic insight, execution excellence, and unwavering client commitment, earning us a strong reputation across the industry.

Website: https://www.starlabsconsulting.com/