A New Era for Global Payments: Strategic Implications of PayPal’s PYUSD Expansion | NEXT Market

Executive Summary

PayPal’s partnership with Stable highlights a critical industry inflection point: stablecoins are no longer just trading tools, but the foundation for next-generation payment infrastructure. The move underscores a broader strategic imperative for financial institutions—rethink global settlement models, capture on-chain value, and position ahead of accelerating adoption in digital payments.

Convergence of Traditional Finance and Crypto

The line between traditional finance and the digital asset ecosystem continues to blur. On September 22, Layer 1 blockchain project Stable, purpose-built for stablecoin adoption, announced a strategic investment from global payments giant PayPal. Through this partnership, users will be able to transact with PayPal USD (PYUSD) directly on the Stablechain network.

By integrating with LayerZero, Stable will bridge PYUSD onto its blockchain, leveraging Stable’s high throughput and low-cost infrastructure to provide near-instant finality and a transaction model optimized for commerce. Beyond this, Stable plans to expand PYUSD’s cross-chain interoperability and on/off-ramp solutions, broadening its use cases across blockchain ecosystems. Over the coming months, the two firms also intend to co-develop innovative payment applications centered on stablecoins, accelerating their adoption across global finance.

Despite PYUSD’s rise to become the third-largest fiat-backed stablecoin, it trails significantly behind incumbents USDT and USDC, which together capture ~85% of market share. Against this backdrop, PayPal’s collaboration with Stable represents a pivotal milestone—signaling stablecoins’ shift from a trading vehicle to a mainstream payment and financial instrument.

Stable: Building the Infrastructure for Global Payments

Stablechain, a Layer 1 blockchain engineered for stablecoins, is fully EVM-compatible, ensuring high transaction throughput, low latency, and a user-first dApp experience. Its focus: enabling efficient, low-cost peer-to-peer payments, remittances, and cross-border transactions.

The chain was developed by Tether (issuer of USDT) and Bitfinex, both under parent company iFinex Inc., with Tether CEO Paolo Ardoino serving as advisor. Stable’s positioning is explicit: the network was “designed for USDT,” supporting real-dollar settlement, sub-second confirmations, gas-free transfers, and leveraging USDT as its native gas token.

Stable’s vision is ambitious: transform USDT—and now PYUSD—into the backbone of global digital payments, creating a multi-stablecoin hub that challenges existing payment rails.

“Global payment infrastructure is overdue for reinvention. Despite strong consumer demand, legacy systems still fail to deliver fast, reliable, and secure digital transactions. Stable was built to unlock the potential of stablecoins like USDT to offer instant, seamless payments.”

— Joshua Harding, CEO of Stable

In July, Stable raised $28 million in seed funding, led by Bitfinex and Hack VC, with participation from Franklin Templeton, Castle Island Ventures, Bybit-Mirana, Hanhwa Group, Nascent, Blue Pool Capital, BTSE, Kucoin Ventures, and angel investors including Bryan Johnson (founder of Braintree).

Three-Phase Roadmap (2025)

- Phase 1 (in progress): Position USDT as the foundational layer and native gas token, enabling sub-second block times and finality.

- Phase 2 (upcoming): Introduce USDT transfer aggregators and enterprise blockspace for efficiency at scale.

- Phase 3: Further performance optimization, plus a full developer toolkit to foster ecosystem growth.

The PayPal partnership reinforces Stable’s pivot from crypto speculation to payment infrastructure, aligning with the rising demand for low-cost, instant settlement in remittances and international e-commerce.

PayPal: Addressing Legacy Pain Points with PYUSD

As one of the world’s most widely used online payment platforms, PayPal controls 45.4% of global online payment share with 429 million active users across 202 countries (DemandSage, 2024).

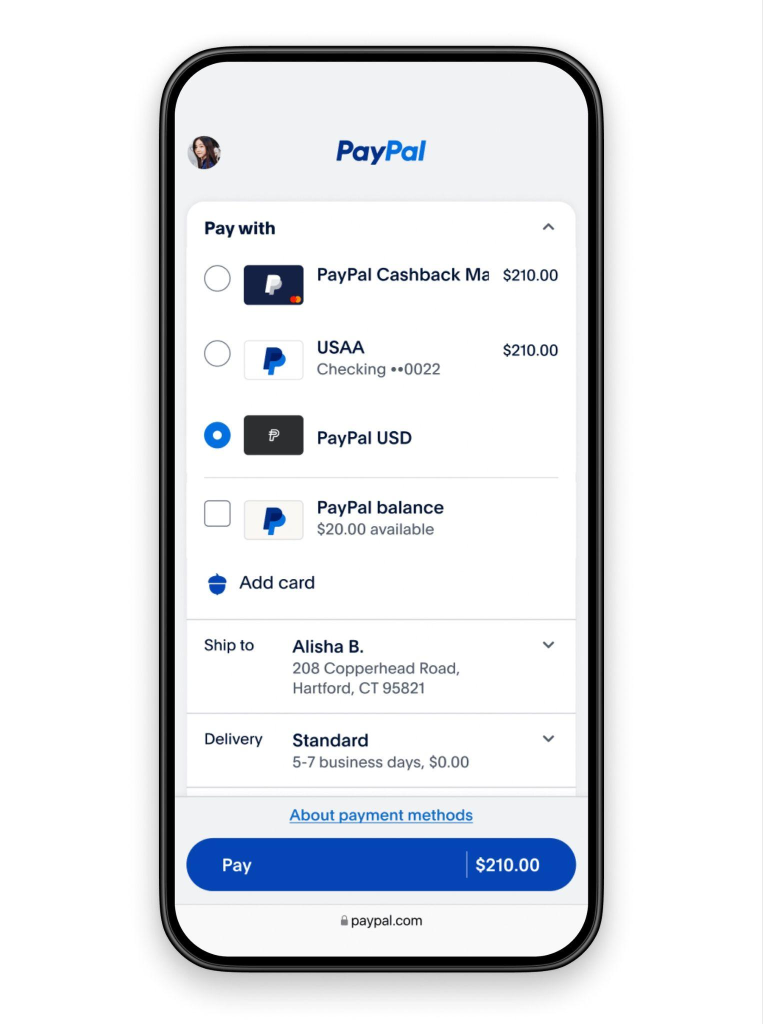

In August 2023, PayPal launched PYUSD with Paxos Trust to tackle legacy pain points—slow settlement and high fees.

Initially native to Ethereum, PYUSD now spans 10 blockchains (Ethereum, Solana, Arbitrum, Stellar, etc.), though still behind USDT (12 chains) and USDC (25 chains).

By end-2025, PayPal aims to offer PYUSD as a settlement option to 20+ million merchants worldwide. Recent product moves highlight its push:

- July: Launched Pay with Crypto, enabling 100+ cryptocurrencies to be accepted and converted into PYUSD for instant settlement, with rewards for PYUSD holders.

- August: Rolled out PayPal World, integrating PYUSD for cross-border payments.

- Recent: Released PayPal Links for one-click, P2P transfers in BTC, ETH, and PYUSD, reducing fees by 90%. Launched in the U.S., with global rollout planned.

These initiatives embed crypto into PayPal’s ecosystem, bridging Web2 payments and Web3 finance.

“We’ve been talking about blockchain for a decade. It only becomes real when you start using it—and that’s what we’re doing now.”

— Alex Chriss, CEO of PayPal

PYUSD has now surpassed $1.4 billion market cap, making PayPal a key player in the stablecoin race.

Stablecoins and the Strategic Shift to Proprietary Blockchains

With global regulatory clarity emerging, stablecoins are evolving into core financial infrastructure, enabling not just trading but also institutional pilots for clearing, settlement, and compliant fund flows.

PayPal’s move has triggered copycats. Fintech giant Fiserv (10,000+ financial institutions) announced plans to launch FIUSD by end-2025. Global banks—JPMorgan, BofA, Citi, Wells Fargo—are also exploring stablecoin adoption.

Stablecoins’ surge has been a windfall for base-layer blockchains. In the past month alone, stablecoin transfers neared 626 million transactions, dominated by Ethereum, Tron, Solana, and BNB Chain. Tron alone processed ~69.8 million transfers, generating $9.7–17.4 million in monthly fee revenue—captured entirely by the chains, not the issuers.

This asymmetry has pushed issuers to pursue proprietary blockchains. Key motivations:

- Revenue capture from transaction fees.

- User experience improvements (stablecoin as gas token, avoiding ETH/TRX).

- Regulatory compliance (blacklisting, AML/KYC features).

- Lower institutional entry barriers for banks and fintechs.

2025: Dual Model Emerges (Stablecoin + Chain)

- Ethena Labs & Securitize: launching Converge, a compliant RWA stablecoin chain.

- Circle: introducing Arc, a chain optimized for RWA and payments.

- Tether: deploying Plasma (retail/small payments) and Stable (institutional/cross-border) networks.

As these networks scale, stablecoin issuers stand to capture blockchain economics while strengthening their position in the global payments landscape. For incumbents, this dual strategy promises both higher margins and increased adoption, while attracting traditional institutions like PayPal into Web3.

In summary: PayPal’s investment in Stable is more than a capital move—it’s a strategic alignment that underscores stablecoins’ evolution from crypto trading instruments to backbone infrastructure for global payments.