The Shortest Path to Financial Innovation: How RWA Is Rewiring the Foundations of Finance | NextMarket

In a macroeconomic environment defined by high volatility and a recalibration of trust systems, the limitations of the traditional financial infrastructure are becoming increasingly evident—concentrated financing channels, illiquid assets, asymmetric information, and persistently high compliance costs. Simultaneously, the crypto sector—recovering from the downturn of 2022—is actively seeking deeper integration with the real economy. The convergence of on-chain and off-chain assets is becoming a central theme.

A case in point: DL Holdings (01709.HK) recently announced its plan to tokenize up to HKD 500 million worth of assets, including equity interests in its Wellington Street property in Central, Hong Kong, and select assets from three managed funds. This signals a growing momentum around RWAs, which are fast emerging as the connective tissue between blockchain-native systems and traditional financial infrastructure.

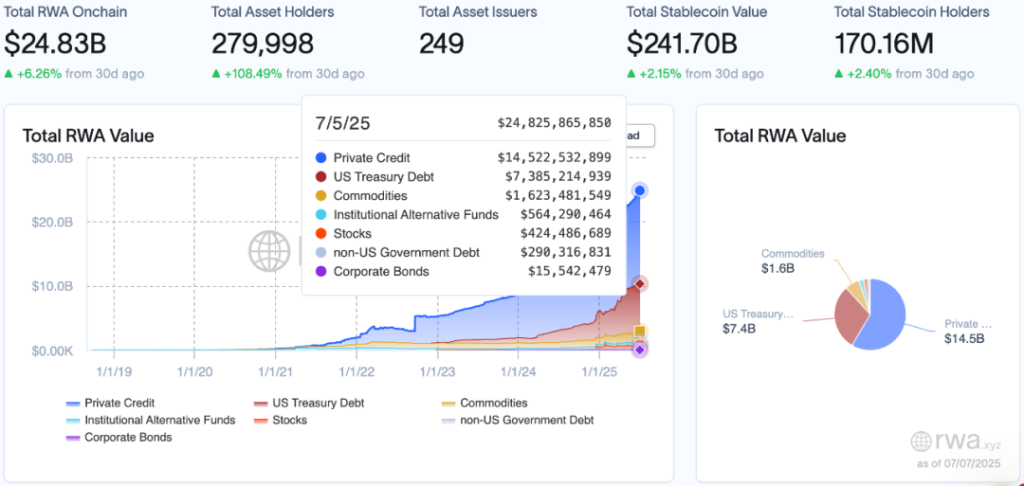

According to RWA.xyz, as of July 5, the total RWA market capitalization reached $24.8 billion, with tokenized U.S. Treasuries accounting for $7.4 billion, and tokenized commodities at $1.6 billion.

Boston Consulting Group forecasts that by 2030, the tokenized RWA market could scale to $16 trillion—40% the size of today’s U.S. Treasury market.

RWA is no longer an experimental layer in the crypto universe. It is emerging as a viable entry point to a reimagined financial system.

RWA Asset Classes: A Strategic Overview

RWAs span a wide range of asset types, each presenting unique technical, regulatory, and operational considerations.

1. Debt-Based RWAs: Tokenized Sovereign and Corporate Bonds

Bonds remain one of the most critical asset classes in global finance—particularly U.S. Treasuries, viewed as the ultimate safe-haven asset.

Among bond-backed real-world assets (RWAs), centralized stablecoins such as USDT and USDC represent the most mature and widely adopted application. According to Tether’s Q1 2025 transparency report, USDT remains the largest stablecoin by market capitalization (approximately $130 billion), with its reserves comprising roughly 60% U.S. short-term Treasury bills and 40% in cash and cash equivalents. Similarly, Circle’s May 2025 reserve report indicates that USDC has a market cap of around $60 billion, backed by 80% U.S. short-term Treasuries (approximately $48 billion) and 20% in cash.

Beyond stablecoins, leading RWA players in tokenized bonds include:

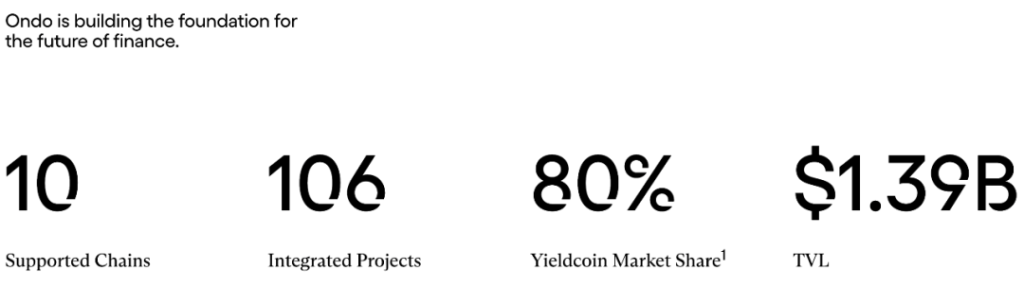

- Ondo Finance: A leading platform offering tokenized exposure to short-term U.S. Treasuries via OUSG, delivering ~5% annual yields. Assets are custody-compliant under U.S. securities law and tradable on-chain. As of latest reports, total value locked (TVL) exceeds $1.39 billion across 106 integrated protocols.

- Maple Finance: Facilitates institutional-grade debt financing in a DeFi-native environment.

- Backed Finance: Offers tokenized bond ETFs such as $bIB01 (tracking iShares Short Treasury Bond ETF), reducing investment friction and enhancing accessibility.

While bond RWAs provide yield stability—ideal for conservative institutional pools—the core challenges lie in transparency of underlying instruments and enforceability in default scenarios.

2. Commodity-Based RWAs: Tokenized Precious Metals and Energy

Gold and other commodities, given their inherent standardization, lend themselves well to tokenization. Leading examples include:

- PAXG (Paxos Gold): Each token is backed by one ounce of LBMA-certified physical gold, stored in Brinks vaults. Highly liquid and used across DeFi platforms.

- XAUT (Tether Gold): Tokenized gold issued by Tether, enabling global trade and DeFi integration.

- Commodities DAO: Exploring on-chain tokenization of oil, copper, and agricultural commodities.

Commodity RWAs depend heavily on trusted custodians and robust cross-chain proof mechanisms to ensure asset authenticity.

3. Equity-Based RWAs: Tokenized Shares of Public and Private Companies

Equity RWAs mirror ownership in listed or private companies. Notable initiatives:

- Robinhood Stock Tokens: Represent equity in over 200 companies, backed 1:1 by actual shares. Tradable on-chain with dividend entitlements.

- xStocks (Backed): Tokenized stocks issued on the Solana blockchain, tradable via both decentralized (e.g., Jupiter) and centralized exchanges (e.g., Kraken, Bybit).

While the addressable market is substantial—potentially exceeding $1 trillion—the regulatory landscape remains uncertain. For example, Robinhood’s tokenized equities are EU-only, while Coinbase awaits SEC approval for its program.

4. Credential-Based RWAs: Carbon Credits and Green Energy Certificates

These assets represent rights or entitlements rather than physical goods.

- MOSS: Tokenizes carbon credits to enable efficient carbon trading and ESG-aligned DeFi applications.

- Celo, Tokens.com, and others are working on tokenizing green energy certificates, turning renewable energy output into programmable on-chain assets.

Their value proposition hinges on trust in the authenticity and authority of the underlying certificates.

5. Real Estate RWAs: Tokenized Property and Infrastructure

Real estate tokenization holds long-term potential but is currently in early-stage pilots in Switzerland, Singapore, and the UAE.

Examples:

- RealT: Tokenizes U.S. real estate, offering fractional ownership and rental income via tokens.

- LABS Group: Targets Asia-Pacific’s luxury real estate market, lowering investment entry barriers.

Challenges include asset non-standardization, subjective valuation, and jurisdictional enforcement complexity.

6. Private Equity and Fund RWAs

Traditional VC and private equity markets are constrained by high thresholds and low liquidity. Tokenization improves access and secondary market potential.

- Hamilton Lane: Issues tokenized private equity funds on-chain, expanding investor access.

- Securitize: A regulated platform enabling fund tokenization and secondary trading.

7. Supply Chain and Receivables RWAs

Projects like Centrifuge and MakerDAO tokenize trade invoices for DeFi use. Others, such as Tranchess, apply structured finance models to supply chain receivables.

Blockchain’s timestamping and programmable transfer capabilities increase efficiency for SME financing.

Why RWA Represents the “Shortest Path” to Financial Innovation

Compared with traditional fintech developments—open banking, neobanks, etc.—RWAs offer compressed innovation cycles and broader systemic impact:

- Capital Efficiency Revolution: 24/7 on-chain trading, composability, and fractional ownership unlock global liquidity. Example: tokenizing a single property into 100,000 units enables global DeFi collateralization.

- Trust Model Reengineering: Blockchain + oracles + auditing replace intermediary-based trust with programmable verification.

- Borderless Asset Portability: Unlike legacy financial instruments, RWAs can be subscribed, traded, and settled globally—e.g., a German DAO investing in Indonesian farm debt and earning USD-denominated yield.

- Real-World Cash Flow for Crypto Finance: RWAs anchor DeFi to fiat-denominated, real-economy cash flows—addressing the ecosystem’s structural dependency on self-referential loops.

Challenges: Compliance, Custody, and Credibility

While the real-world asset (RWA) vision is compelling, its path to large-scale adoption is fraught with complexity—foremost among them, regulatory compliance risks. Key challenges include: the legal disconnect between on-chain and off-chain asset frameworks, divergent regulatory interpretations across jurisdictions, and the potential for regulatory arbitrage.

Traditional assets are typically governed by well-established national legal and regulatory frameworks. Once tokenized and introduced into blockchain-based environments, these assets may fall under heightened scrutiny from regulators, with limited policy readiness to address cross-domain digital asset flows.

Today, many countries have yet to establish clear or comprehensive regulatory regimes for crypto assets. This lack of clarity becomes particularly pronounced in the cross-border transfer of tokenized assets, significantly elevating investor risk. For example, legally transferring real estate or bonds onto a blockchain platform—and ensuring compliance across jurisdictions—remains a grey area. A single RWA product may be categorized differently across markets: as a security in the U.S., a payment instrument in Singapore, or a digital asset in Hong Kong, exposing participants to inconsistent legal interpretations.

Beyond compliance, technical challenges also persist. During tokenization, critical questions emerge: How can tokens reliably and accurately reflect the underlying asset’s value and liquidity profile? How should participants assess credit or default risk on-chain? What roles should auditors play in verifying the integrity of these assets?

Currently, the digitization of RWAs often requires traditional intermediaries—such as banks and legal institutions—for valuation, certification, and custody. This reliance introduces a “pseudo-decentralization” dilemma, where central entities retain control over key components of the asset lifecycle, thus reintroducing custodial concentration risk.

Moreover, technological vulnerabilities remain a concern. Risks such as oracle failures, cyberattacks, and smart contract bugs can lead to substantial asset loss. While smart contracts offer efficiency gains in asset settlement and lifecycle management, a single flaw in code can have systemic implications.

As a result, Starlabs Consulting emphasizes that any RWA project seeking to achieve commercial scalability and sustainability must integrate capabilities across multiple domains: financial engineering, legal compliance, on-chain governance, auditing, and core technical architecture.

What’s Next: From “Usable” to “Universal”

Based on Starlabs Consulting’s analysis, several strategic trends will shape the RWA landscape over the next 24 months:

- Modular RWA Infrastructure: Cross-chain communication protocols (e.g., Chainlink CCIP, Hyperlane) will serve as bridges between ecosystems.

- Rise of Tokenized Funds: RWA ETFs and institutional-grade token products will gain traction among asset managers.

- Central Bank Engagement: Regulators such as the HKMA and Swiss National Bank are integrating CBDC pilots with RWA projects.

- DAO-Driven Governance: Communities will participate directly in credit scoring, asset auditing, and dividend distribution—disintermediating legacy financial institutions.

- AI-Powered On-Chain Credit Systems: Advanced analytics integrating borrower behavior, macro indicators, and blockchain data will improve asset pricing and risk segmentation.

RWA is not merely about “putting assets on chain.” It redefines asset ownership, liquidity models, settlement processes, and governance mechanisms. More fundamentally, it signals a broader shift toward disintermediation, programmability, and global capital mobility. For financial institutions, tech companies, and regulators, RWAs represent both a generational opportunity—and a profound challenge to legacy frameworks of trust, law, and market design.

About NextMarket

Presented by Starlabs Consulting, “NextMarket” offers strategic perspectives on how emerging technologies and shifting capital dynamics are redefining global markets. The series explores the intersection of finance, technology, and enterprise innovation—providing clarity on the forces shaping the next generation of economic value.

About Starlabs Consulting

Starlabs Consulting is a global leader in strategic and marketing consulting for the Web3 industry. Founded in 2018, we specialize in delivering end-to-end solutions across strategic planning, financial advisory, PR and marketing, risk forecasting and management, regulatory and legal compliance, crisis management, and innovation research.

We are committed to helping visionary companies navigate complexity in their growth, marketing, and operations — empowering them to thrive in competitive markets. With deep Web3 expertise and an extensive global network, Starlabs Consulting is the trusted partner of choice for many of the world’s leading crypto exchanges. Our professional team is known for its strategic insight, execution excellence, and unwavering client commitment, earning us a strong reputation across the industry.

Website: https://www.starlabsconsulting.com/