Wall Street Strikes Back: NYSE and Nasdaq Redefine the Tokenized Securities Ecosystem

On January 19, the world’s largest stock exchange—the New York Stock Exchange (NYSE)—announced that it is developing a tokenized securities trading platform with on-chain settlement, subject to regulatory approval.

The platform will offer 24/7 trading of U.S. equities and ETFs, support fractional share trading, introduce stablecoins to enable T+0 instant settlement, and support multi-chain custody and settlement.

This follows Nasdaq’s submission to the U.S. Securities and Exchange Commission (SEC) in September 2025 of a proposal covering tokenized stocks and ETPs. It marks another major traditional financial institution formally entering the tokenized securities space.

In fact, tokenized securities are not new. From early DeFi experiments, to short-lived centralized exchange booms, to compliance-driven exploration by fintech and crypto-native firms, the concept has evolved over the past eight years.

Now, with the world’s two largest stock exchanges—NYSE and Nasdaq—both moving into tokenized securities, what does this mean for traditional finance and the crypto community? How will it reshape the integration of blockchain and capital markets? In this issue of Next Market, Starlabs Consulting reviews the evolution of financial infrastructure upgrades and reconstruction across asset nature, issuance mechanisms, and compliance frameworks.

While tokenized securities are not new, having evolved over the past eight years from DeFi experimentation to centralized exchange trials and fintech compliance efforts, the entry of NYSE and Nasdaq represents a structural shift. This article reviews the evolution of tokenized assets and examines how traditional financial infrastructure is being fundamentally upgraded.

Early Exploration and the Awkward Positioning of Tokenized Assets

Tokenized assets have gone through three waves of experimentation. Each attempted to bridge traditional finance and crypto. The first two were effectively killed by markets or regulators. The third is caught between market expansion and regulatory constraints.

1. DeFi Protocols and Synthetic Assets

In 2018, Ethereum-based DeFi protocol Synthetix pioneered tokenized equities through the concept of “synthetic assets.” Users could over-collateralize SNX to mint tokens tracking real-world assets such as U.S. stocks and commodities (e.g., sTSLA, sAAPL, sGOOGL).

Synthetix’s core advantage was full decentralization and censorship resistance. However, the need for over-collateralization led to low capital efficiency and a persistent risk of price decoupling from underlying assets.

In December 2020, Mirror Protocol launched tokenized assets on Terra, allowing users to mint mAssets (e.g., mTSLA, mGOOGL) by over-collateralizing UST.

However, Mirror failed to solve the fundamental problems: prices relied entirely on oracles, creating divergence risk; liquidity was constrained by over-collateralization; and the model depended heavily on Terra’s stability. After the Terra/UST collapse in 2022, this entire category of synthetic assets was marginalized.

2. CEX “Equity Certificates”

In 2020, FTX launched tokenized stocks backed by the German-regulated broker CM-Equity AG. Users could trade Tesla and Apple tokens or engage in leveraged trading.

This model appeared to solve DeFi’s liquidity problem but introduced fatal centralized credit risk: users did not own real shares, only “economic claim certificates” backed by the exchange and broker. Custody and transparency depended entirely on third parties. After FTX’s collapse in 2022, its tokenized stock business vanished.

In April 2021, Binance launched similar products backed by CM-Equity AG but shut them down within three months due to regulatory pressure. BaFin questioned compliance with EU securities law, and Hong Kong’s SFC clearly opposed unlicensed securities trading.

BISS, a crypto-stock platform, was also investigated by Chinese regulators in 2019, with several executives detained.

These exits exposed the core weakness of the CEX model: unclear regulatory frameworks, blurred business boundaries, opaque custody, and high risk of crossing regulatory red lines.

3. Compliance-Compromised “Shadow Assets”

By 2025, with clearer crypto regulation and the rise of RWA narratives, fintech firms like Robinhood and crypto-native companies like Undo Finance launched a third wave, using licensing + SPV structures to compete for the tokenized securities opportunity.

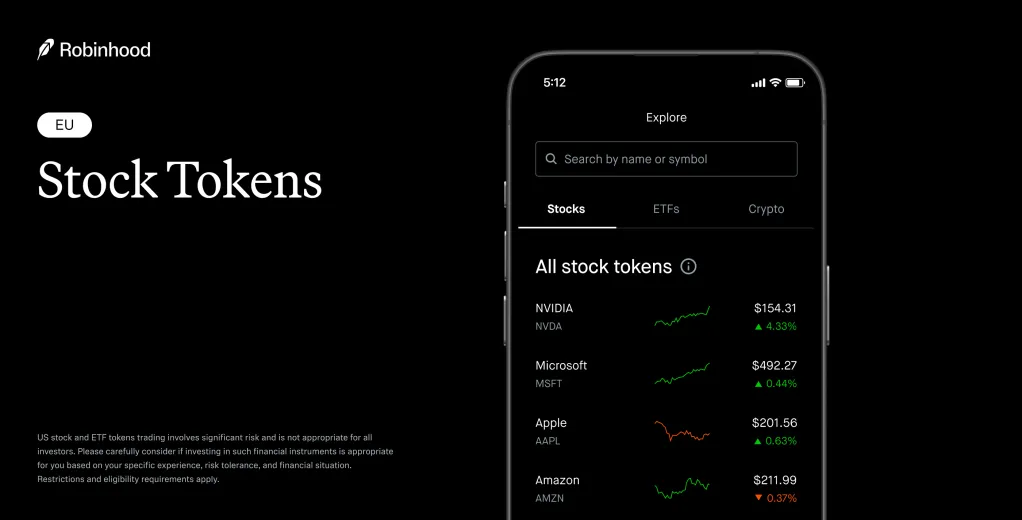

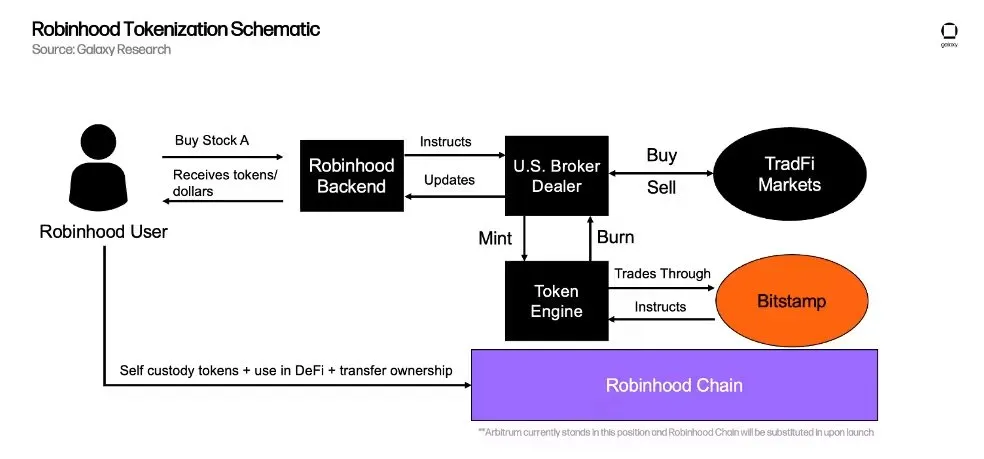

In late June 2025, Robinhood announced “Stock Tokens” for EU users, covering 200+ U.S. stocks and ETFs, supporting five-day 24-hour trading and fractional shares. Tokens were issued on Arbitrum and later supported by Robinhood’s own Arbitrum-based L2.

Robinhood’s advantage lay in compliance: its Lithuanian entity Robinhood Europe, UAB obtained an investment firm license under MiFID II.

Robinhood claimed 1:1 backing with real shares and dividend rights, but the structure still relied on traditional custody + on-chain mapping. In July 2025, the Bank of Lithuania questioned its token architecture and transparency.

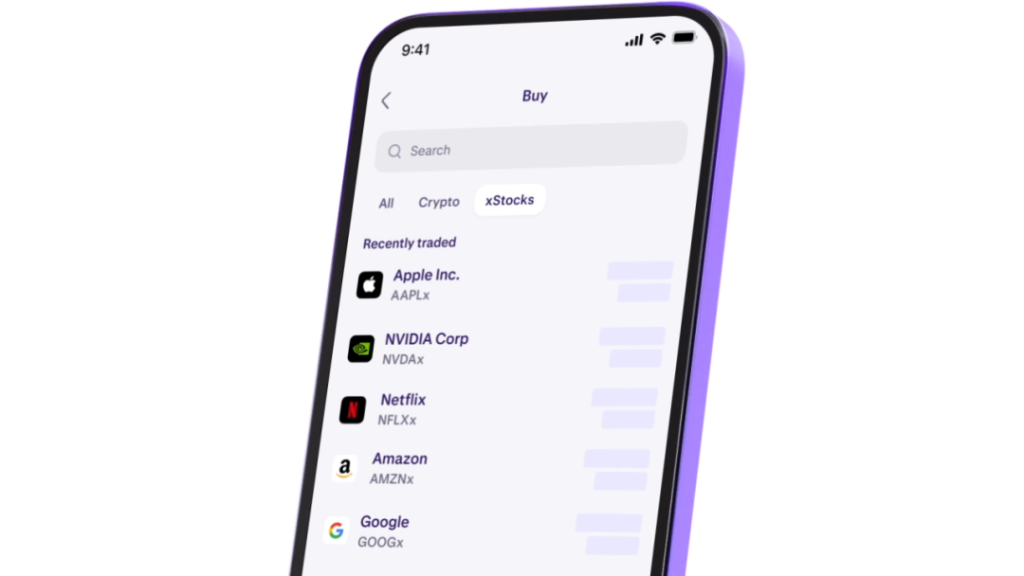

Meanwhile, xStocks, issued by Swiss firm Backed and regulated by FINMA and Jersey’s JFSC, launched on Solana but excluded U.S. and parts of Europe due to regulatory risk.

Ondo Finance, Dinari, and INX Digital also entered the field.

Ondo formed a Global Markets Alliance with BitGo, Fireblocks, and Alpaca.

Dinari raised $22.65M and uses on-demand tokenization.

INX holds SEC broker-dealer and FINRA membership and launched tokenized equity $DAKS.

Despite improved compliance, all rely on SPV structures—users hold claims on SPVs, not real shares, without full governance rights. These are “shadow assets,” not native securities.

While compliant, this structure still relies on traditional custody and creates legal separation between token holders and actual shareholders. Token holders receive dividends but not full governance rights—making these instruments “shadow assets” rather than native securities.

NYSE and Nasdaq: Reconstructing the Logic of Tokenization

The core problem in previous models was structural: crypto and fintech players tried to “wrap” securities using blockchain, but could not replace the legal and infrastructural foundation of capital markets.

NYSE and Nasdaq reverse this logic. Instead of using crypto to simulate securities, they are making securities themselves blockchain-native—backed by regulatory authority and institutional infrastructure.

NYSE: Native Securities on-Chain and Settlement Reengineering

NYSE’s platform supports interchangeable tokenized stocks and natively issued digital securities.

First, asset equivalence: tokenized securities are legally identical to stocks—dividends, voting, liquidation rights intact.

Second, efficiency revolution: Pillar matching engine remains, but blockchain becomes the system of record. Settlement shifts from T+1 to T+0. ICE partners with BNY Mellon and Citi to introduce tokenized deposits.

Third, three-layer advantage:

• Liquidity gravity

• Legal certainty

• Infrastructure dominance

Nasdaq: Rules First, Infrastructure Second

Nasdaq’s approach starts with regulation. In October 2025, the SEC approved Nasdaq proposal SR-NASDAQ-2025-072.

Key elements include:

- Redefining securities to include tokenized forms.

- Allowing “tokenized settlement” instructions to flow to DTC.

- Ensuring equal order priority between tokenized and traditional securities.

- Assigning DTC as the official settlement authority.

DTC systems are expected to support tokenized settlement by Q3 2026.

This approach integrates tokenized securities directly into existing exchange infrastructure, preserving liquidity and minimizing behavioral change for issuers and investors.

The Road Ahead: Tokenization as Infrastructure, Not Disruption

NYSE and Nasdaq signal that tokenization will not replace traditional finance—it will be absorbed into it.

Stablecoins will evolve from crypto trading tools into core components of cross-border securities settlement. RWA platforms will move from SPV-based “shadow assets” toward legally native, fully compliant structures.

The competitive edge will not lie in technology speed alone, but in regulatory integration and ecosystem coordination.

Conclusion

The 234-year history of the NYSE reflects continuous infrastructure upgrades—from paper trading to electronic matching, from T+3 to T+1 settlement. Tokenization is the next chapter in this evolution.

The race is not about blockchain adoption per se, but about who can build the first compliant, scalable, cross-market tokenized securities system. Those who succeed will define the next era of global capital markets.