The Global Stablecoin Race: Regulation, Institutions, and Asia’s Rise as the Next Growth Engine

A Perspective from Starlabs Consulting

Introduction: Stablecoins Enter the “New Financial Infrastructure” Era

By 2025, stablecoins have moved beyond being peripheral to the crypto ecosystem. They are rapidly emerging as a new category of foundational financial infrastructure—assets increasingly embedded in the global financial system.

Regulatory momentum is a key catalyst. Hong Kong has passed its landmark Stablecoin Bill; Circle, issuer of USDC, has listed on the NYSE; and the U.S. Senate has advanced the GENIUS Act. Together, these developments signal a global pivot—stablecoins are exiting regulatory grey zones and entering frameworks of institutional compliance.

Meanwhile, Asia is taking the lead. From Hong Kong and Singapore to South Korea and the UAE, governments are laying the groundwork for a competitive edge in this new asset class. Financial institutions, technology leaders, and Web3-native platforms are converging in what is fast becoming a high-stakes race to shape the next generation of programmable money.

Demand Surges: Adoption of Stablecoins Accelerates

Standard Chartered forecasts that the stablecoin market could grow nearly tenfold—reaching USD 2 trillion by 2028, up from USD 230 billion today. Deutsche Bank echoes this trajectory, citing growth from just USD 20 billion in 2020 to USD 246 billion in 2025.

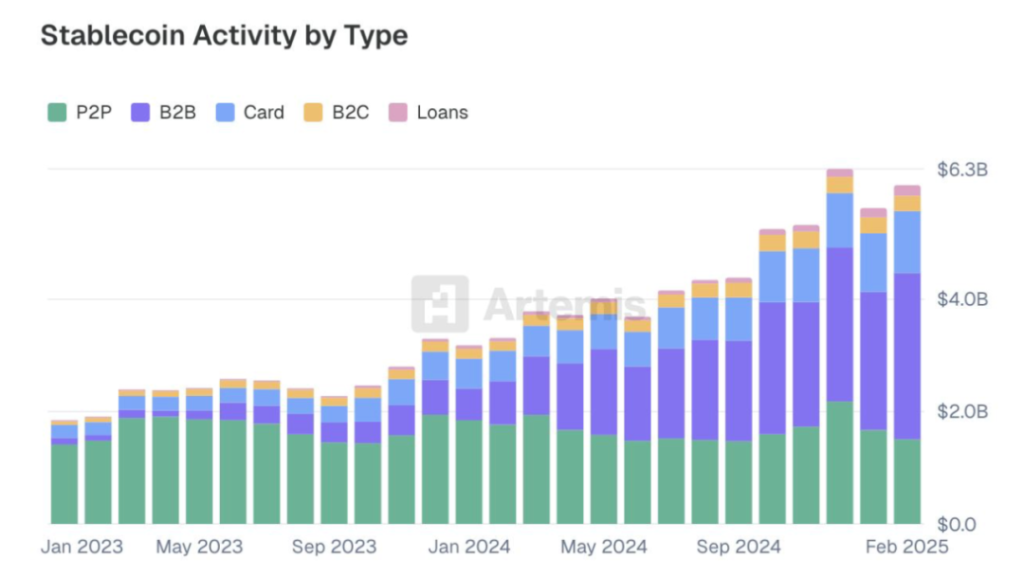

One of the clearest signals of mainstream acceptance is the successful public listing of Circle, the world’s second-largest stablecoin issuer. Beyond headlines, the shift is underpinned by hard numbers: Artemis data shows that global stablecoin settlements topped USD 94.2 billion between January 2023 and February 2025.

Business-to-business (B2B) use cases are leading the charge, accounting for over USD 36 billion in annualized volume. Other segments—P2P payments (USD 18B), card-linked usage (USD 13.2B), and B2C transactions (USD 3.3B)—are expanding rapidly.

At Starlabs Consulting, we observe that stablecoins are evolving from “crypto cash equivalents” into “programmable liquidity instruments.” They are now functioning as “on-chain fiat” or “on-chain settlement currencies,” supporting everything from corporate treasury operations to global remittances. Their appeal lies in borderless transferability, near-instant clearing, low fees, and stability—traits increasingly sought after in traditional and digital finance alike.

Regulation Materializes: Stablecoins Come Onshore

In 2025, a wave of global regulatory clarity has redefined the stablecoin landscape:

- Dubai: The DFSA added Circle’s USDC and EURC to its token regime in February.

- Abu Dhabi: Paxos and Circle secured in-principle approvals from ADGM for issuance and digital asset services.

- Hong Kong: On May 21, the Legislative Council enacted a pioneering Stablecoin Bill emphasizing licensing, retail permissions, and reserve transparency.

- Singapore: The Monetary Authority of Singapore issued updated guidelines for Digital Token Service Providers on June 6, strengthening the regulatory foundation.

- South Korea: A proposal by the ruling party on June 10 signaled forthcoming legislation to integrate stablecoins into the financial system.

- United States: The U.S. Senate passed the GENIUS Act on June 17, mandating full reserves, redemption rights, and regulatory oversight—a framework that validates Circle’s compliance-first approach.

- European Union: The MiCA framework, which came into effect at the end of 2024, has sparked a significant uptick in euro-denominated stablecoin issuance.

At Starlabs Consulting, we view this regulatory shift as a strategic unlocking mechanism. Regulation acts not as friction, but as an institutional on-ramp—bridging Web2 and Web3, East and West, and laying the groundwork for interoperable financial innovation.

Institutional Surge: Web2 and Web3 Compete on a Unified Stage

With licensing frameworks crystallizing, large-scale enterprises are moving decisively. In May 2025, ADQ, First Abu Dhabi Bank, and IHC announced plans for a dirham-backed stablecoin, subject to CBUAE approval.

In June, Ant Group disclosed applications for stablecoin licenses in Hong Kong and Singapore. JD.com went further—Chairman Richard Liu announced plans to secure licenses for major global currencies, aiming to slash cross-border costs by 90% and cut transaction times to under 10 seconds.

Preparations are well underway. According to the HKMA, JD Chain, RD InnoTech, and a joint venture among Standard Chartered, Animoca, and HKT are already enrolled in Hong Kong’s regulatory sandbox. Full licensing applications begin August 1.

South Korea’s Kaia network is also entering the fray, working with LINE and Kakao on a won-backed stablecoin now in early-stage development.

Our advisory work reveals that demand is intensifying for B2B-oriented, regulatory-compliant stablecoin solutions. Institutions capable of delivering auditability, licensing alignment, and technical interoperability are poised to dominate the next chapter of digital finance.

Stablecoins Shift East: Asia as the Next Growth Engine

Asia is emerging as the gravitational center of stablecoin innovation, driven by a mix of policy foresight, cross-border use cases, and digital infrastructure maturity.

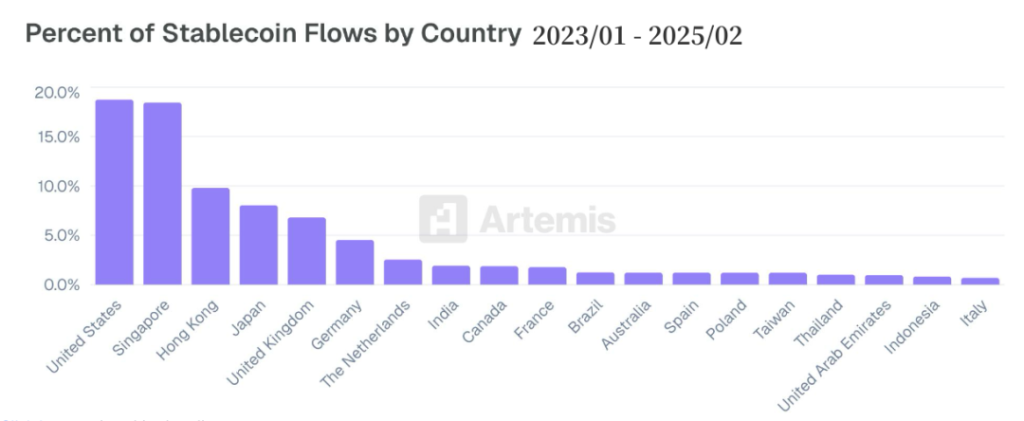

According to Artemis, the U.S. and Singapore each account for ~20% of global stablecoin circulation, followed by Hong Kong at ~10%. Regulatory clarity is a key factor:

- Hong Kong’s regime includes robust requirements on retail sales and reserve convertibility. Legislator Duncan Chiu notes that issuers may use HKD, offshore RMB, or EUR, emphasizing practical use over domestic currency nationalism.

- Singapore allows stablecoins pegged to any G10 currency under its Digital Payment Token (DPT) framework. Local issuer StraitsX has achieved broad adoption with its SGD-linked XSGD.

As the world’s largest trade bloc, Asia accounts for nearly 40% of global merchandise flows. Starlabs sees stablecoins anchored to HKD, RMB, and SGD as increasingly viable complements to the U.S. dollar—especially in regional settlements, trade financing, and FX hedging. This trend dovetails with rising interest in de-dollarization and new monetary multipolarity.

Strategic Implications: Gaining First-Mover Advantage

For issuers and infrastructure providers

Build early capabilities in compliance, auditability, reserve transparency, and redemption. Focus on licensing in forward-leaning jurisdictions such as Hong Kong and Singapore.

For investment and payment platforms

Prioritize stablecoins with regulatory approvals. Assess fit based on currency peg diversity (USD, HKD, EUR, RMB, SGD) and jurisdictional risk. Stablecoins can enhance clearing efficiency, cost structures, and user experiences.

For policymakers and consortiums

Encourage cross-border regulatory harmonization to reduce fragmentation and regulatory arbitrage. Enable real-world use cases by supporting compliance-ready infrastructure and standardized reporting.

Conclusion: More Than Currency—Stablecoins as the Protocol Layer of Finance

Stablecoins are no longer fringe financial experiments. They are fast becoming the protocol layer for a more interoperable, programmable, and borderless financial future.

At Starlabs Consulting, we remain committed to tracking global policy trends, infrastructure developments, and institutional strategies. In doing so, we help enterprises secure early-mover advantages in this transformative era of monetary innovation.