Tokenized Equities: The Next Frontier in the Convergence of Wall Street and Web3 | NextMarket

From spot Bitcoin ETFs and stablecoin legislation to tokenized stocks, the fusion between crypto and traditional finance is gaining momentum.

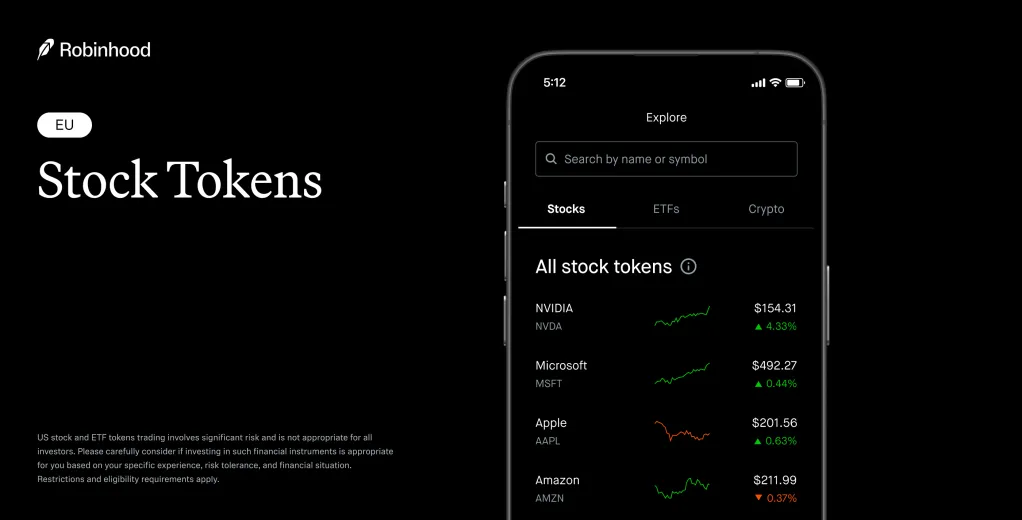

On June 30, Robinhood (NASDAQ: HOOD), the U.S. brokerage giant, introduced Robinhood Stock Tokens, enabling EU users to trade U.S. equities and ETFs directly on-chain. That same day, Swiss financial issuer Backed launched its tokenized stock product xStocks, now trading on both Kraken and Bybit.

Eight crypto-native firms have entered the tokenized equities market, leveraging a variety of blockchain networks (Arbitrum, Solana, Base, Ondo Chain) and custody models (self-custody, xStocks, BitGo) to meet global investor demand for flexibility, on-chain transfers, and regulatory assurance. Tokenized equities are emerging as a tangible real-world asset (RWA) use case.

Will Tokenized Equities Be the Next Breakout RWA Use Case After Stablecoins?

Robinhood: A Full-Stack Brokerage Platform Building Its Own Layer 2

Robinhood first introduced crypto trading in 2018. While it has faced temporary trading halts, volatility concerns, and regulatory actions—including SEC scrutiny—it has consistently expanded its crypto strategy:

- 2021: Acquired Cove Markets, a crypto trading aggregator

- 2022: Launched Robinhood Wallet, supporting Ethereum, Polygon, Arbitrum, Optimism, and Base

- May 2025: Acquired WonderFi, a Canadian operator of regulated exchanges Bitbuy and Coinsquare

- May 2025: Secured an EU-wide brokerage license from the Bank of Lithuania under MiCA

- June 2024: Acquired Bitstamp, gaining access to its MiFID MTF license and 50+ regulatory registrations

- July 2025: Announced acquisition of AI-driven advisory platform Pluto

As of November 2024, Robinhood custodied $38 billion in crypto assets and processed $119 billion in nominal crypto trading volume over the previous year, offering ETH and SOL staking in all 50 U.S. states.

On June 30, 2025, Robinhood launched tokenized stock trading for EU users, enabling 24/5 access to 200+ U.S. equities and ETFs. Each token is 1:1 backed by the corresponding stock, transferable on-chain, and dividend eligible. Tokens are initially issued on Arbitrum and will migrate to Robinhood Chain, its planned Layer 2 network.

Additionally, Robinhood now offers perpetual crypto futures for European users—completing a product suite that spans spot, derivatives, staking, wallets, RWAs, and AI analytics.

Starlabs Consulting notes that Robinhood has also proposed a federal framework for tokenized RWAs to the SEC and plans to launch a dedicated exchange—Real World Asset Exchange—for off-chain trading and on-chain settlement.

Coinbase: Awaiting SEC Approval to Launch Tokenized Equities

According to Reuters (June 17), Coinbase is seeking SEC approval to launch a blockchain-based tokenized equity platform. If approved, Coinbase will compete directly with Robinhood and Charles Schwab.

Coinbase received a broker-dealer license in 2018, but has yet to initiate operations under this license.

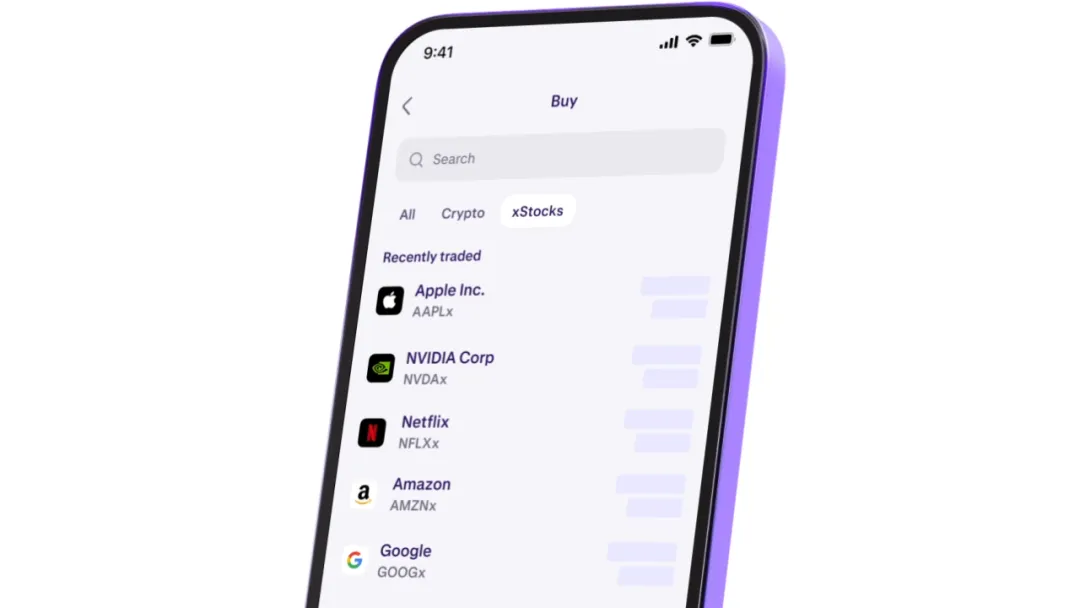

xStocks: Now Trading on Kraken, Bybit, and Solana’s DeFi Ecosystem

Backed, a Swiss financial issuer, launched xStocks, tokenized representations of public equities regulated by FINMA. These tokens are issued on Solana and integrated with the broader DeFi ecosystem.

On June 30, Kraken listed 60 xStocks for non-U.S. clients, available 24/5. Kraken plans a phased rollout across Europe, Latin America, Africa, and Asia.

Bybit also partnered with Backed, listing top U.S. stocks and ETFs on its spot platform with 24/7 trading, tailored to Web3-native behavior.

Dinari: Launches Tokenized MicroStrategy Shares on Gemini

On June 27, Gemini and U.S.-based Dinari launched a tokenized version of MicroStrategy (NASDAQ: MSTR), initially for EU users. The token is live on Arbitrum, with support for additional chains planned.

Dinari has raised $22.65 million from VanEck Ventures, Hack VC, F-Prime Capital, Blockchange Ventures, and Balaji Srinivasan. The firm aims to offer access to over 100 tokenized U.S. equities and financial assets, positioning itself as a Web3-native broker-dealer for global users.

Ondo Finance: Creating a Global Platform for Tokenized Securities

DeFi protocol Ondo Finance is developing Ondo Global Markets, a platform designed to tokenize U.S. equities, bonds, and ETFs for non-U.S. investors, with 24/7 settlement and DeFi-native integration.

The firm draws parallels between the rise of stablecoins and the opportunity in tokenized securities—both solve access, cost, and friction problems in traditional finance.

On June 17, Ondo launched the Global Markets Alliance to improve interoperability, investor protection, and access to tokenized RWAs. Founding members include:

- Solana Foundation

- BitGo (custody)

- Fireblocks (Web3 security)

- Jupiter, 1inch (DEX aggregators)

- Trust Wallet, Bitget Wallet, Rainbow Wallet

- Alpaca (broker-dealer and regulatory compliance)

Each plays a specialized role: wallets integrate Ondo’s token standards, aggregators automate token discovery, and infrastructure is provided by BitGo and Fireblocks.

INX Digital: Launching Tokenized Private Equity via Aktionariat

On June 18, INX Digital—a U.S. regulated tokenized asset platform—partnered with Swiss startup Aktionariat AG to launch tokenized equity $DAKS on the INX Marketplace, accessible to global investors.

INX holds SEC and FINRA licenses, including broker-dealer and ATS status. Aktionariat has facilitated CHF 50+ million in tokenized private equity transactions since 2021, serving over 30,000 users and helping tokenize 70+ private companies with a combined valuation of CHF 400 million.

Market Outlook: Tokenized Equities Still in Their Infancy

As of June 30, data from RWA.xyz shows total tokenized real-world assets reached $24.47 billion:

- $7.385 billion in tokenized U.S. Treasuries

- $341 million in tokenized equities

While tokenized equities remain a small slice of the RWA pie, institutional interest is surging due to the potential for low-cost, real-time access to U.S. markets.

According to Cointelegraph, STOKR CEO Arnab Nask stated that the total addressable market for tokenized stocks is “undoubtedly multi-trillion-dollar,” though hard to precisely size.

Dinari’s Chief Business Officer Anna Wroblewska noted that 2025 has seen “explosive demand” from Web3 wallets, neobanks, and TradFi firms, with interest far broader than expected.

“There’s immense demand for U.S. public equities—even among retail investors globally. Tokenization makes access faster and cheaper,” Wroblewska said, noting that tokenized Treasuries are already in high demand for similar reasons.

Starlabs Consulting observes that despite the S&P 500 and Nasdaq hitting all-time highs, with total U.S. equity market capitalization at $61.94 trillion and federal debt exceeding $36 trillion, tokenized stock value remains under $400 million. The market opportunity remains vast.

About NextMarket

Presented by Starlabs Consulting, “NextMarket” offers strategic perspectives on how emerging technologies and shifting capital dynamics are redefining global markets. The series explores the intersection of finance, technology, and enterprise innovation—providing clarity on the forces shaping the next generation of economic value.

About Starlabs Consulting

Starlabs Consulting is a global leader in strategic and marketing consulting for the Web3 industry. Founded in 2018, we specialize in delivering end-to-end solutions across strategic planning, financial advisory, PR and marketing, risk forecasting and management, regulatory and legal compliance, crisis management, and innovation research.

We are committed to helping visionary companies navigate complexity in their growth, marketing, and operations — empowering them to thrive in competitive markets. With deep Web3 expertise and an extensive global network, Starlabs Consulting is the trusted partner of choice for many of the world’s leading crypto exchanges. Our professional team is known for its strategic insight, execution excellence, and unwavering client commitment, earning us a strong reputation across the industry.

Website: https://www.starlabsconsulting.com/